This is already a great budgeting sheet that lets you keep track of things with ease.

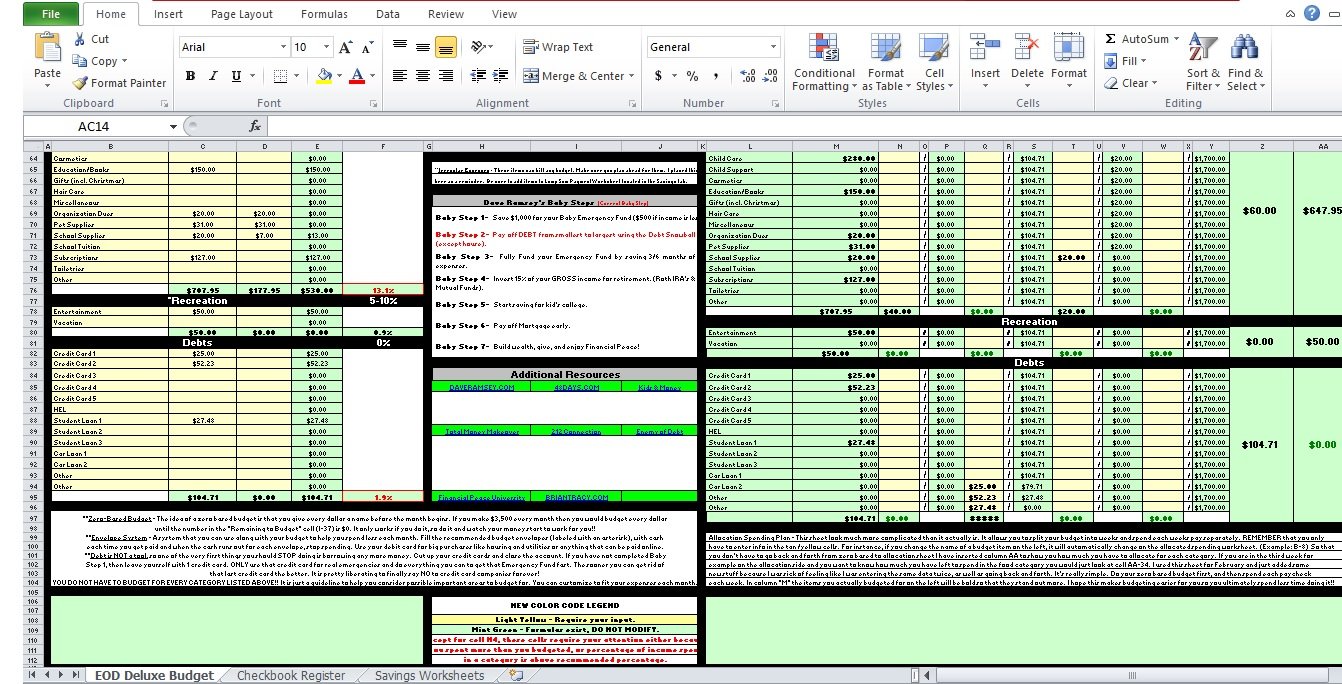

If you want to keep things super simple, you can stop here. This is your spreadsheet, get creative and customize it for your needs! Of course, you can expand this further by adding more details, such as the payment method, notes, and more. It seems easy enough just start with what I have done below:

You should also include the amount of money spent, and the date of the expense. Try adding as many monthly expenses as possible. First, list all of your bills on one side. Setting up your workbook for finances is easy.

#Making a personal budget in excel install

Alternatively, you can install Microsoft Excel from the Office 365 app store. If you don't own the application yet, check out our store and purchase Microsoft Excel. Each month is different because there's more income coming in than out, but it's necessary to track in order to make better decisions.īefore you can begin creating your ultimate budgeting spreadsheet, you need to get access to Excel. Your spending habits are logged so you can decide where to cut costs. Use Microsoft Excel for your financial spreadsheets to access them anywhere with Office 365. No matter how much detail you are expecting about your income or spending habits, having an Excel budget will help maintain control over your finances. If you have more than one account for your income and expenses, it's important to track them separately. Knowing where my income is coming from and where it's going gives me greater control over my financial decisions. Each day, the money I save makes a huge difference. This will ensure that you are on track with your finances and can meet future goals.įor example, I am saving to purchase my first home. With this guide, you can stay on track with your longer-term financial goals.īudgeting is a great way to keep track of your spending, income, and savings.

#Making a personal budget in excel how to

So, today, you’ll learn about how to use Excel to manage your finances to simplify your day-to-day money decisions. While most people use Excel to track their budgets, manually updating your budget spreadsheet every month is a time-consuming process.īut with the right knowledge of Excel, you can make the process a more seamless experience. But having the right tools can help make it less challenging. Managing personal finances is a daunting prospect for most people. You will learn how to use Microsoft Excel to manage and save money. So, if you’re intimidated by the idea of using Microsoft Excel to manage your finances, you’re in the right place. This blog post is your ultimate guide to how to manage your finances with Microsoft Excel.

0 kommentar(er)

0 kommentar(er)